Get FREE SHIPPING on books today!

Decades of Borrowers' Work, Properties and Savings Taken

Greek Isles Hotel Owner Blamed "Greedy Hedge Fund Guys" for Wiping Out the Owners' Equity and Pushing the Property into an Involuntary Chapter 11, Died Soon After at Age 50

A Canyon Partners affiliate made a $56 million loan to the Greek Isles Hotel and Casino. The developer, Harold Rothstein, was quoted by the Las Vegas Review-Journal, blaming “‘greedy hedge-fund guys’ interested in wiping out the owners’ equity stake” and stated that the creditors had “taken approximately $14 million in fees and interest out of the property.” Read more at: https://www.reviewjournal.com/news/greek-isles-hotel-forced-into-bankruptcy/ . In December 2008, Canyon Partners Real Estate (or their affiliate) was able to get a receiver appointed and in August 2009, foreclosed on the 202-room Casino Hotel. After the project was taken by Canyon, Rothstein reportedly moved to Arizona and soon after died at 50 years old on May 18, 2011. His family said he was never the same after Canyon took the property.

Canyon Partners' 1st Quarterly Investment Report for 2014 boasts of this foreclosure. That Investment Report and many others which prove Canyon's rampant rate of foreclosing are available by emailing news@canyonpartnersnews.com. Canyon Partners has alleged that these reports are copyrighted in their bid to shield evidence of their rampant foreclosures from public dissemination.

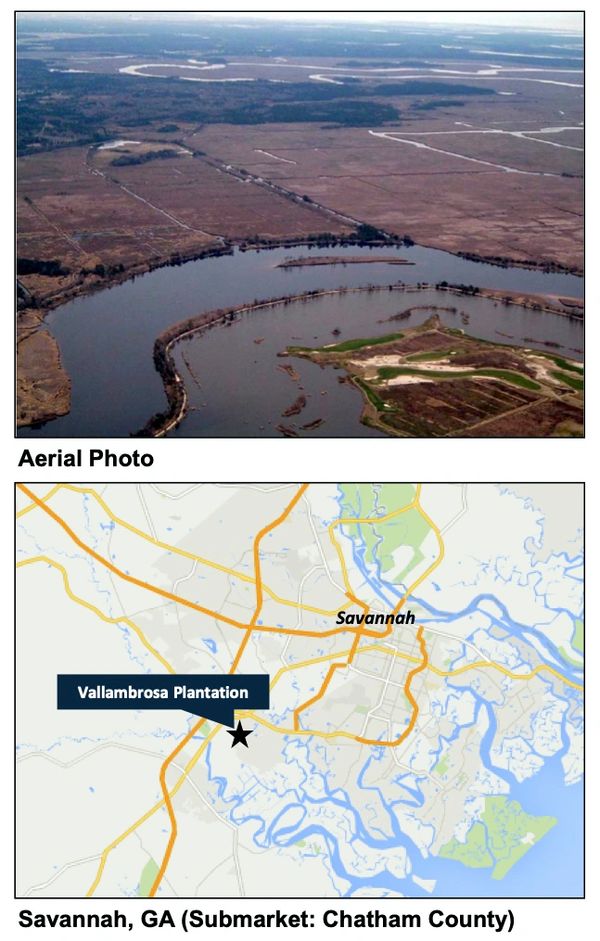

Canyon Forecloses on Vallambrosa Project consisting of 8,212 acres of land in Savannah, Georgia

Canyon Partners caused a loan to be made in the amount of $28 million for a development project known as Vallambrosa in South Chatham County Georgia. The loan, which was to be used to clear the site and make improvements to the property, had a maturity date on or about March 29, 2008, at which point the parties had contemplated a stage two loan of approximately $60,250,000 for the physical development of the property. Even though the loan agreement had provisions for a 6-month extension of the maturity date and even though they held and/or controlled undisbursed reserves for interest and development costs, on or about April 1, 2008, Canyon Partners caused the developer to be notified that the loan had matured and attempted to extract from the developer an additional 1,600 acres of land as a precondition for their compliance with the extension provisions of the loan documents. When the developer refused to comply, Canyon initiated and ultimately caused the foreclosure on the property after the owner attempted to re-organize in a Chapter 11 bankruptcy proceeding. Vallambrosa's bakruptcy filing said, "Because Debtor Vallambrosa did not obtain and convey as additional collateral the 1,600 acres of additional real estate, Canpartners continued on its course of attempting to obtain title to Debtor's Vallambrosa Project. Canpartners seized several hundred thousand dollars which were held in various reserve accounts of Debtor Vallambrosa with Canpartners, and has refused to give any accounting for the amounts seized, or the application of funds. Canpartners commenced foreclosure on the entire Debtor's Vallambrosa Project, a portion of which was appraised at $76,000,000 when the $28,000,000 loan was made. Debtor Vallambrosa filed this Chapter 11 Case to preserve Debtor's Vallambrosa Project and to enable Debtor Vallambrosa to repay Canpartners and all other creditors on a orderly basis from development of Debtor's Vallambrosa Project. After Debtor Vallambrosa filed this Chapter 11 Case, Canpartners next sought foreclosure on Jewett Tucker's 100% membership interest in the Vallambrosa tract...Jewett Tucker ultimately filed Chapter 11 to preserve his membership interest..."

Case Cite: In Re Vallambrosa Holdings, LLC, US Bankruptcy Ct (SD GA), Case No.08-40791, Doc 69, p 9.

Canyon Partners' 1st Quarterly Investment Report for 2014 boasts of this foreclosure. That Investment Report and many others which prove Canyon's rampant rate of foreclosing are available by emailing news@canyonpartnersnews.com. Canyon Partners has alleged that these reports are copyrighted in their bid to shield evidence of their rampant foreclosures from public dissemination.

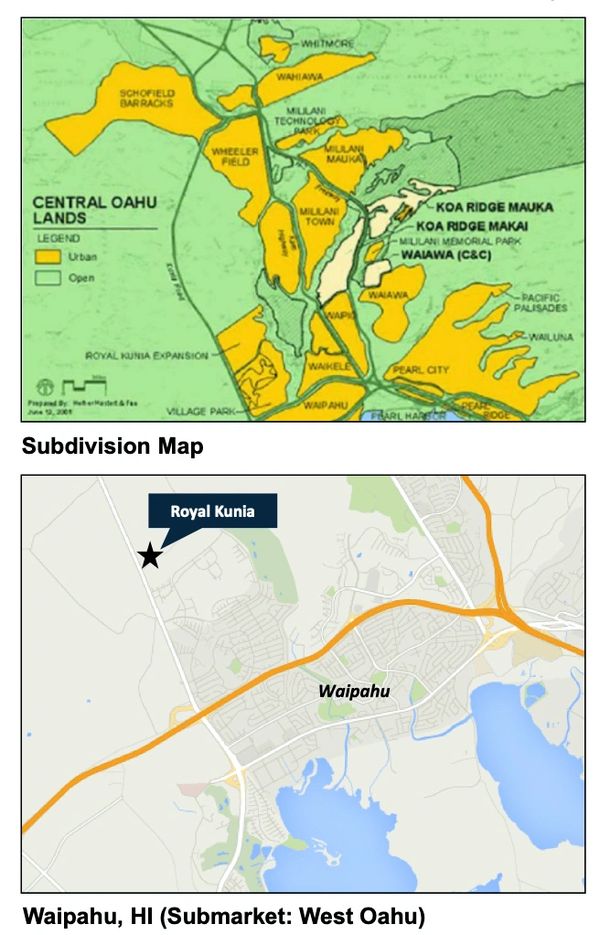

Oahu's 161-Acre Royal Kunia Land Zoned for 2,007 Units, Yet Another Canyon Foreclosure and Another Bankruptcy

Canyon Capital Realty Advisors made a $41.25 million senior loan on a 161 acre site zoned for 2,007 units in Honolulu. There was a subordinate loan made by CMR. First, Canyon had the Borrower pay an extension fee of $1.4M. Then Canyon swept the loan reserves of $6.1M, and commenced a UCC foreclosure of the Borrower's membership interest. CMR, Canyon's co-lender, asserted in court filings "a number of claims against Canyon regarding Canyon's wrongful conduct" including "Canyon's bad faith attempts to deprive CMR of its interest in the real property security for its promissory note." The court filings stated that, "after CMR had completed the structure for a workout of the Project and the agreements with Borrower were virtually ready to sign, Canyon balked, advising that it required a Pre-Negotiation Agreement, which contained a number of releases, be executed prior to signing the documents. Shortly after executing that agreement and accepting payments from CMR, Canyon refused to extend the term of its A Note, even though it had accepted the $1.375 million CMR paid as an extension fee". And, "On or about August 14, 2008, Canyon unilaterally seized the money in the reserve accounts, including over $6 million..." CMR filed its Amended Complaint For Breach Of Contract, Breach Of Covenant Of Good Faith And Fair Dealing, Breach Of Fiduciary Duty, Negligence, Negligent Performance Of Voluntary Duty, Aiding And Abetting, Reformation, Equitable Estoppel And Equitable Subordination on May 29, 2009 . CMR pled, "Canyon engaged in a series of acts intending to create the illusion that Canyon was complying with the Agreement while undermining the substance of that Agreement through acts which were highly prejudicial to CMR’s rights and interests, and attempting to eliminate CMR’s rights and interests in the Property, the Project, the Loan and the security, to render CMR’s Note without value, to leave CMR without recourse for any recovery on that promissory note, and to obtain a windfall." CMR also argued that Canyon presented the court with an appraisal that "substantially undervalues the property". Still, CMR filed for bankruptcy and approximately 6 months later, Canyon took sole ownership of the asset, wiping out both the junior lender, CMR, and the borrower.

Case Cite: In Re CMR Mortgage Fund, LLC, US DC (ND CA), Case No. 3:10-CV-0477, Appellant’s Opening Brief.

Canyon Partners' 1st Quarterly Investment Report for 2014 boasts of this foreclosure. That Investment Report and many others which prove Canyon's rampant rate of foreclosing are available by emailing news@canyonpartnersnews.com. Canyon Partners has alleged that these reports are copyrighted in their bid to shield evidence of their rampant foreclosures from public dissemination.

Canyon Initiated Foreclosure on the Hooter's Hotel In Las Vegas, Borrower Files Chapter 11 to Block and Asserts that Canyon "Is Not a Roman Emperor Who Can Decide Life and Death for Others", Still Canyon Ultimately Got Their Property

The 696-room Hooters Hotel on Tropicana Avenue, just east of the Las Vegas Strip, filed for Chapter 11 bankruptcy reorganization and protection on Aug. 1, 2011 to block a foreclosure by Canpartners Realty Holding Co. IV. Both sides attempted to negotiate a settlement, but when talks broke down, Canyon pushed for a foreclosure. Hooters then filed Chapter 11 to stop the action.

The Las Vegas Sun reported, "Canpartners also objected to plans by Hooters to hire professionals to seek new funding or a buyer..." "Canpartners is stating that it will never agree to any proposal, and therefore, the court should end this proceeding. If one takes this to its logical conclusion, then in every Chapter 11 case, a secured creditor has a veto over the Chapter 11 case. Canpartners knows that this is not the way it works; that it is not a Roman emperor who can decide life and death for others simply by a thumbs up or down," said Hooters' filing. Read article entitled, "Hooters casino presses for right to reorganize" at: https://vegasinc.lasvegassun.com/business/gaming/2011/sep/12/hooters-casino-presses-right-reorganize/ .

The Las Vegas Sun also reported that, "Attorneys for Hooters, besides arguing Canpartners’ plan jeopardizes the rights of holders of the $3 million in debt not held by Canpartners, called Canpartners’ motion 'manipulative' and its legal theories a 'perverse misconstruction' of the bankruptcy law. Hooters complained Canpartners is attempting an end-run around the bankruptcy law that gives Hooters a 120-day period since its bankruptcy filing in which it exclusively can propose a plan of reorganization. The plan 'simply runs roughshod over obvious and fundamental Bankruptcy Code provisions and Bankruptcy Rules,' said Hooters’ response, filed by attorneys with the Las Vegas law firm Gordon Silver." Read article entitled, "Hooters Las Vegas hits back against foreclosure attempt" at: https://vegasinc.lasvegassun.com/business/legal/2011/oct/03/hooters-las-vegas-hits-back-against-foreclosure-at/ .

Also: https://www.salon.com/2012/02/19/main_lender_of_hooters_in_vegas_to_become_owner_2/

Court records indicate that Canyon bought the corporate bonds with a face value of $127.5 million for just $28 million, giving it 99 percent of the secured debt at a very low basis. Soon thereafter, Canyon was able to foreclose and the hotel's ownership interest was lost to Canyon.

Canyon Partners' 1st Quarterly Investment Report for 2014 boasts of this foreclosure. That Investment Report and many others which prove Canyon's rampant rate of foreclosing are available by emailing news@canyonpartnersnews.com. Canyon Partners has alleged that these reports are copyrighted in their bid to shield evidence of their rampant foreclosures from public dissemination.

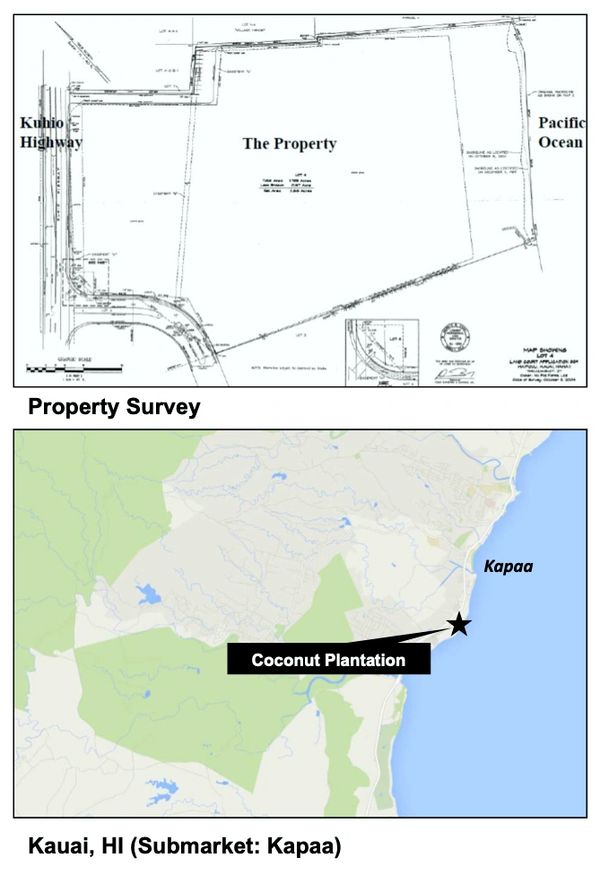

Canyon Forecloses on Another Borrower: This Time The Unfortunate Borrower Lost the 12-acre Coconut Plantation in Kauai to Canyon

A Canyon affiliate made a $9 million bridge loan to Coconut Plantation Holdings secured by nearly 12 acres of land. In April 2008, Canyon declared the borrower in default and months later commenced foreclosure proceedings. Canyon's foreclosure was completed in March 2009.

Canyon Partners' 1st Quarterly Investment Report for 2014 boasts of this foreclosure. That Investment Report and many others which prove Canyon's rampant rate of foreclosing are available by emailing news@canyonpartnersnews.com. Canyon Partners has alleged that these reports are copyrighted in their bid to shield evidence of their rampant foreclosures from public dissemination.

Canyon Successfully Foreclosed on Cal Neva, a 219-room Hotel on 13.5 acres in Lake Tahoe, California/Nevada

A Canyon affiliate made a $25 million loan to Cal Neva, a 219-room hotel and casino in Lake Tahoe, which straddles the Nevada and California state lines. As was often done, Canyon declared the borrower to be in default, installed a receiver and foreclosed in 2009. The loan guarantor, Ezri Namvar, felt compelled to file for personal bankruptcy protection during the loan relationship with Canyon. Read that "Ownership falls to lender" at: https://www.reviewjournal.com/business/cal-neva-fails-to-catch-bid-at-foreclosure-auction-ownership-falls-to-lender/ .

Canyon Partners' 1st Quarterly Investment Report for 2014 boasts of this foreclosure. That Investment Report and many others which prove Canyon's rampant rate of foreclosing are available by emailing news@canyonpartnersnews.com. Canyon Partners has alleged that these reports are copyrighted in their bid to shield evidence of their rampant foreclosures from public dissemination.

Canyon Wrested Control of College Terrace in Palo Alto

100 Year Property Owners Lose Everything in Months

The College Terrace property had been owned by the same family for approximately 100 years. The family wished to develop the College Terrace property, which is in Palo Alto. The College Terrace loan from Canyon closed in December 2013.

College Terrace Centre in Palo Alto

After 100 Years of Ownership, Canyon Captures Property After The Family Had Owned the Land Worth Approximately $15-20 Million and Which Was Free-and-Clear of Any Debt Before Development Activities Began

Canyon's Big Pre-Closing Lie

Just prior to closing, one of College Terrace’s principals raised the following prescient concern with the mortgage broker: "Well my assessment is this – Jonathon [Roth of Canyon] is a personable, charming person who has not stayed the course and is squeezing the numbers to ensure our failure, all with a smile on his face." The College Terrace principal continued: "Marti [Page of Canyon] is not to be trusted and has altered agreements, taken intent out of context from the Term Sheet to her own benefit and has delayed this discussion until it puts them in what they perceive as ultimate power…, she is either unethical or devious. . . . In my opinion, they have positioned the property to facilitate their takeover to building. Heck, they even had me meet their surrogate and advise her on local resources. It seems clear that this is their intent. On this note – I need for you to disclose how many foreclosures they have had over the past five years as this will be a critical piece of information in the decision process on how or if we are to proceed." The next day, December 28, 2013, Marti Page remarkably stated in response that: "We have not foreclosed on a development deal from what I can remember." That was of course far from the truth!

Canyon's General Counsel, Marcus Neupert, Partakes in Lie About Canyon's Foreclosure History

As of December 28, 2013, Canyon had foreclosed on at least nine (9) developments - likely many more. In a clear demonstration of the culture at Canyon Partners, Canyon's General Counsel, Marcus Neupert, was copied on Page’s response, and he did not correct the misstatement, even though he is the in-house General Counsel for Canyon Partners Real Estate. See email above. To the extent one wishes to give Marti Page the benefit of the doubt in terms of her memory, on September 14, 2018, in her deposition testimony, she admitted knowing that one of the nine developments, Cal-Neva, had been placed in foreclosure.

In reliance upon Marti Page’s outright lie about Canyon's foreclosure history, on December 31, 2013, College Terrace closed on the loan from a Canyon affiliate on December 31, 2013.

In approximately two months after the loan closing, College Terrace's owners reported that Canyon repeatedly declared defaults against College Terrace for manufactured non-monetary allegations regarding violations of contract terms not contained in the loan documents. See letter excerpt demanding $3 million, which was not a requirement in the loan documents and absurd language which stated that Canyon was providing an accommodation!

Soon thereafter, College Terrace reported that Canyon pressured College Terrace Centre LLC into signing releases and paying default interest by withholding funds legitimately due to College Terrace under the loan documents, and further pressured College Terrace within just six months of the loan closing to sign documents which included granting to Canyon a springing deed-in-lieu of foreclosure if Canyon elected to declare another default. College Terrace stated that Canyon then intentionally caused construction delays to increase costs to the point where College Terrace was forced to admit Canyon's hand-picked crony developer into control of the project.

By 2018, without any court proceeding being filed, Canyon's relentless acts ultimately led to College Terrace losing 100% of its equity in the project plus more money that Canyon reportedly coerced from the owners of College Terrace after the loan closing.

All of this occurred without College Terrace missing or being late on a single loan payment.

The property owners did not have funds to pay lawyers to fight Canyon and thus succumbed to Canyon's predatory acts.

Canyon Foreclosed on East Coast Fisheries Project in Miami, Developer Died Soon After Losing His Property and Life Savings. Widow Said He Never Recovered from Canyon's Acts

Beginning in approximately 2006, Canyon Partners made a loan to River Drive Partners LLC in Miami-Dade County, Florida that resulted in foreclosing on the borrower’s property in May 2007 in connection with an approximately $16 million loan. According to attorneys and the widow of the developer, Canyon manufactured defaults to force into foreclosure the East Coast Fisheries property, which had been in the Swartz family for generations. According to the attorney for River Drive Partners LLC, Canyon's loan was “death-spiral financing” designed to lead to the property owner’s downfall. In conversations with Rebecca Swartz, the widow of the developer, Ms. Swartz reflected about Canyon Partners, “They steal your money, steal your time, steal your property, and steal your future." Soon after her husband's property and life-savings were lost to Canyon, Mr. Swartz was diagnosed with cancer and died shortly thereafter.

Canyon Captured Renowned Franklin Place Project from Developers in NYC. Developer Said Just Mentioning the Name, Maria Stamolis, Put Shivers Down His Spine

In approximately 2011, Canyon's Co-Head of Real Estate, Maria Stamolis, and others at Canyon Partners refused to approve a planned inter-creditor agreement for the 5 Franklin Place development in lower Manhattan thereby denying it the necessary financing to complete the project and in turn, ultimately causing the New York development to be foreclosed upon.

In a conversation with the developer who has since moved to Florida and has tried to move on with his life, he said, "Just the mentioning of the name, Maria Stamolis, put shivers down my spine. I feel sorry for anyone who comes across that woman."

Read more at: https://cityroom.blogs.nytimes.com/2011/09/02/big-deal-chronicle-of-a-project-foreclosed/

Canyon Partners Yet Again Frustrated Loan Repayment and Developer Said Canyon Made False Statements to a US Bankruptcy Court, This Time about South Flower Street Project in Los Angeles

In July 2008, a Canyon affiliate loaned up to approximately $84 million to 845 South Flower Street LLC, the owner of a 35-story condominium tower in the Chinatown section of Los Angeles, California. Records show that Canyon falsely claimed in a bankruptcy proceeding that the borrower had failed to meet substantial completion milestone dates, when in fact, in or about September 2009, the borrower had obtained timely from the City of Los Angeles the requisite Temporary Certificate of Occupancy. Canyon Partners impeded both the closing of the sale of condominium units and repayment of the loan by causing both the withholding of construction draw payments and refusing to release lien(s) on the condominium units. According to the developer, Canyon Partners made false representations to the bankruptcy court concerning the value of the condominium units too. Court records show that in November 24, 2009, MM 845 Flower demanded that Canyon release the Chinatown Property, including by issuing a full reconveyance with respect to the Chinatown Deed of Trust. By letter dated November 30, 2009, Canyon notified MM 845 Flower that it refused to release the Chinatown Property.

Case Cite: In re Meruelo Maddox - 845 S. Flower Street, LLC, US Bcy Ct (CD CA), Bk Case No. 1:09-bk-21621-KT; Adv. Case No. 1:09-ap-01435-VK, Doc 16.

Canyon Partners Affiliate Accused of Being A Vulture Fund and Utilizing a Loan-to-Own Strategy on the 110 Green Street Development

A Canyon Partners entity loaned approximately $12,400,000 to 110 Green Street Development LLC, a 131-unit residential redevelopment project. In an all too familiar pattern, the project was forced into bankruptcy. The Debtor stated in court filings that it had concluded “that by late January of 2009, the Canyon Partners affiliate adopted a ‘battle-ready’ position and sought to declare the Debtor in default on a number of trivial and pretextural matters” and “was intent on capturing the inherent potential of the Project for itself.” The realdeal.com wrote that "the developer filed for bankruptcy to protect the building from the mezzanine lender Canyon-Johnson, because it feared Canyon Capital might pursue a 'loan-to-own' strategy and take control of the building." Canyon was referred to as a "vulture fund" in bankruptcy pleadings and that it "loans to own".

Bankruptcy records reveal that in March 2009, Canyon Partners sought to dismiss the Debtor’s bankruptcy petition, as Canyon has successfully done many times. As part of that effort, Canyon's Co-Head of Real Estate, Maria Stamolis, represented to the bankruptcy court that the project was “not even remotely suitable for occupancy” giving the impression to the court “that the Building still requires extensive construction,” and that the Debtor remained in default for not meeting the construction completion date. Yet in fact, Stamolis knew that the Debtor had obtained a final certificate of occupancy on January 28, 2009. The developer's bankruptcy filing said that Maria Stamolis's "assertions regarding construction are disingenuous in the extreme, particularly since she knows full well that the Debtor obtained a final certificate of occupancy for the Building on January 28, 2009", which was attached to the court filing. The filing went on to say, "The issuance of a final certificate, of course, speaks volumes as to the true state of construction and exposes the Mezzanine Lender's false innuendos and misrepresentations." It went on to say, "Stamolis, in turn, personally 'congratulated' the Debtor for its efforts on January 30, 2009, only to submit a dubious affidavit a scant three weeks later, falsely declaring that the Project is woefully incomplete..." The Court pleadings said that Canyon's entity was "groping for issues to press its own agenda." Also, the Debtor stated that Canyon's “assertion that the Building’s purported appraised value has fallen to between $39-44 million” was a lie, since it knew that the Fannie Mae appraisal reflected “a much higher value.”

Read more at: https://www.cityrealty.com/nyc/greenpoint/110-green-street/review/43961

Case Cite: In re 110 Green St. Development LLC, US Bcy Ct (ED NY), Case No. 09-40860, Doc 30.

Canyon Took Ownership of the Valuable Intracoastal Mall in North Miami Beach and Was Accused of Pressuring Borrower to Sign a Deed-in-Lieu of Foreclosure

In 2012, Canyon Partners placed into default another borrower, this time, the Intracoastal Mall, a Florida development. The court filings reflect an all-too-familiar playbook: Canyon Partners “colluded to prevent” Intracoastal’s performance under the Loan, “fabricated” “sham” defaults to steal the property and “starve[d] the property from income” by “rejecting leases that are indisputably commercially reasonable” and “sweeping – without notice” funds necessary to pay operating expenses to create bogus defaults” to support ’ claims. The court filings said, "This account sweeping - without notice to defendants - was oppressive and calculated to hinder and prevent defendants' ability to perform under the loans at issue here." It went on to say that, "...plaintiff has misconstrued, misapplied, and miscalculated ...in an oppressive and bad faith manner to fabricate a sham default designed to allow plaintiff to improperly wrest control of the property from Defendants.... Again, these actions, individually and collectively, are designed to improperly use the foreclosure proceeding to wrest control of a profitable commercial shopping center from its rightful owners." In the proceeding, Canyon even claimed a default for nonpayment of property taxes that were "not yet calculated and not yet due".

Shortly thereafter, Canyon took ownership of the Intracoastal Mall, a 328,886-square-foot property in North Miami Beach. Woolbright Development gave up the property to Canyon affilliate, CJUF III Intracostal, via a $59.8-million deed-in-lieu of foreclosure. Watch Maria Stamolis, Canyon's Co-Head of Real Estate, testify about what a deed-in-lieu of foreclosure is designed to do - see the Videos page.

Case Cite: CJUF III Intracoastal v MSW Intracoastal Mall, Miami-Dade County Court, Case No. 2011-032699-CA-06.

https://www.bizjournals.com/southflorida/news/2012/02/24/fashion-mall-in-foreclosureagain.html

Developer of Former May Company Department Store Building Tormented by Canyon Partners

A Canyon affiliate made a loan to Waterbridge Capital and investor Jack Jangana to redevelop the 1 million-square-foot Broadway Trade Center in downtown Los Angeles. Completed in 1908, the nine-story structure was originally home to the A. Hamburger & Sons department store until the May Co. acquired the property in 1923. As the May Company Building, it housed the retail store until the mid-1980s, when it became a multi-use retail trade center.

Waterbridge and Jangana bought it to transform the vintage property into a premier destination that offers creative office space and flagship retail spaces on the ground and second floors while also respecting its historic architecture.

In 2014, according to the developer, Canyon Partners tormented them by creating a relentless series of default notices beginning immediately after the loan documents were signed.

The developer, Joel Schreiber, said that Canyon put his entity into default approximately two days after the loan closed and thereafter the entire loan relationship with Canyon was miserable. He said that Canyon refused to fund the last $20 million too. Schreiber said he didn't take a vacation and was miserable for years dealing with Canyon. Finally, he said that he had to overpay by millions of dollars otherwise Canyon refused to discharge their mortgage.

Canyon Filed Suit to Install Its Hand-Picked Receiver on the Fashion Mall in Broward County, Florida, Forcing Another Canyon Borrower to File for Bankruptcy Protection

In 2007, Canyon Partners caused a loan to be made to U.S. Capital Holding LLC for approximately $56 million to build a shopping mall in Broward County, Florida known as U.S. Capital/Fashion Mall. Canyon attempted to have a Florida state court appoint a receiver to control the property on the ground that U.S. Capital Holdings LLC allowed the property to deteriorate, even though it was in the same condition as when the loan had been made. Canyon said in its lawsuit that U.S. Capital agreed if the loans were to go into default, then U.S. Capital would not have the right to contest a foreclosure.

U.S. Capital's proposed redevelopment of the property, dubbed 321 North, called for 650,000 square feet of retail, two office buildings totaling up to 400,000 square feet and up to 600 residential units.

U.S. Capital's lawyers argued that the appointment of a receiver was improper because the value of the property far exceeded the debt and Canyon was not in danger of losing the value of the loan if a receiver was not appointed.

Court papers stated that the most recent appraisal of the property valued it at slightly more than $89 million yet Canyon was owed $56 million.

U.S. Capital was forced to file for bankruptcy protection to retain control and refinance its property. U.S. Capital was a rare Canyon borrower that was able to fend off Canyon's actions and successfully emerged from bankruptcy with new financing.

Canyon Paid At Least Six Law Firms to Capture the George in Ann Arbor and Litigation is Continuing! Canyon's Legal Fees May Exceed $10 Million Already

Just Twelve Checks to the law firms of Dickinson Wright and Sidley Austin Are Shown Above. There are Dozens or Perhaps More Than 100 Additional Checks for Legal Fees Spanning Seven Calendar Years and Counting - All to Capture One Developer's Property When No Loan Payments Were Missed!

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.