Get FREE SHIPPING on books today!

Canyon's Marcus Neupert Partakes in Major Pre-Closing Lie

The College Terrace property had been owned by the same family for approximately 100 years. The family wished to develop the College Terrace property, which is in Palo Alto. The College Terrace loan from Canyon closed in December 2013.

Canyon's Big Pre-Closing Lie

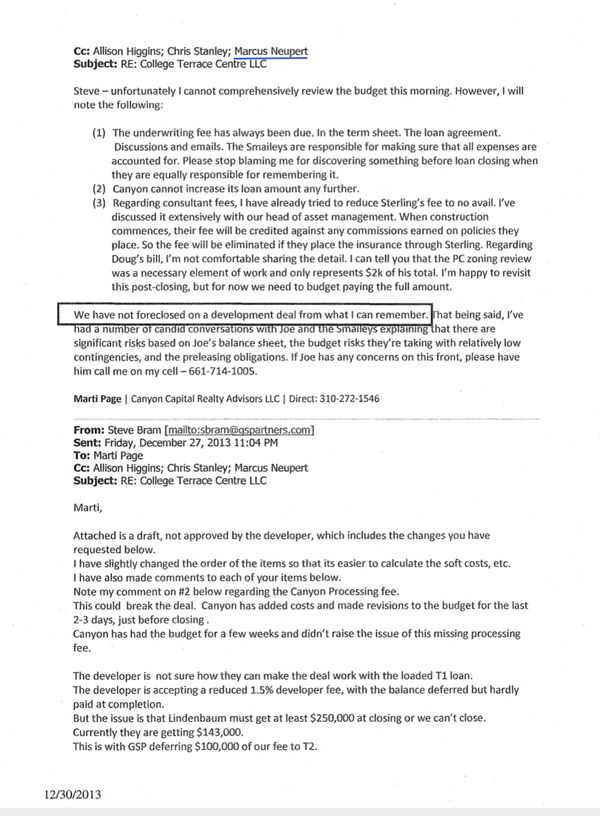

Just prior to closing, one of College Terrace’s principals raised the following prescient concern with the mortgage broker: "Well my assessment is this – Jonathon [Roth of Canyon] is a personable, charming person who has not stayed the course and is squeezing the numbers to ensure our failure, all with a smile on his face." The College Terrace principal continued: "Marti [Page of Canyon] is not to be trusted and has altered agreements, taken intent out of context from the Term Sheet to her own benefit and has delayed this discussion until it puts them in what they perceive as ultimate power…, she is either unethical or devious. . . . In my opinion, they have positioned the property to facilitate their takeover to building. Heck, they even had me meet their surrogate and advise her on local resources. It seems clear that this is their intent. On this note – I need for you to disclose how many foreclosures they have had over the past five years as this will be a critical piece of information in the decision process on how or if we are to proceed." The next day, December 28, 2013, Marti Page remarkably stated in response that: "We have not foreclosed on a development deal from what I can remember." That was of course far from the truth!

Canyon's General Counsel, Marcus Neupert, Partakes in Lie About Canyon's Foreclosure History

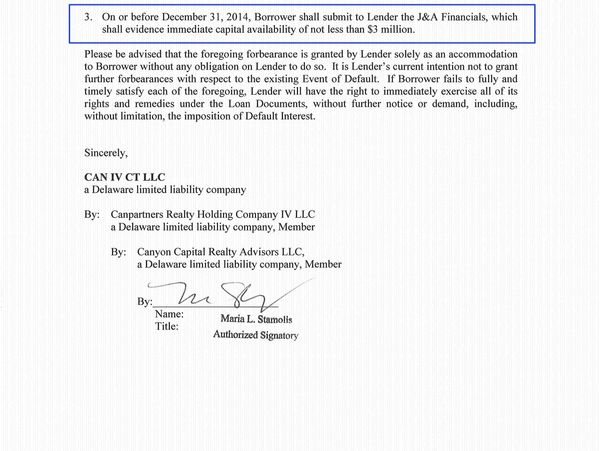

As of December 28, 2013, Canyon had foreclosed on at least nine (9) developments - likely many more. In a clear demonstration of the culture at Canyon Partners, Canyon's General Counsel, Marcus Neupert, was copied on Page’s response, and he did not correct the misstatement, even though he is the in-house General Counsel for Canyon Partners Real Estate. See email above. To the extent one wishes to give Marti Page the benefit of the doubt in terms of her memory, on September 14, 2018, in her deposition testimony, she admitted knowing that one of the nine developments, Cal-Neva, had been placed in foreclosure. In reliance upon Marti Page’s outright lie about Canyon's foreclosure history, on December 31, 2013, College Terrace closed on the loan from a Canyon affiliate on December 31, 2013. In approximately two months after the loan closing, College Terrace's owners reported that Canyon repeatedly declared defaults against College Terrace for manufactured non-monetary allegations regarding violations of contract terms not contained in the loan documents. See letter excerpt demanding $3 million, which was not a requirement in the loan documents and absurd language which stated that Canyon was providing an accommodation! Soon thereafter, College Terrace reported that Canyon pressured College Terrace Centre LLC into signing releases and paying default interest by withholding funds legitimately due to College Terrace under the loan documents, and further pressured College Terrace within just six months of the loan closing to sign documents which included granting to Canyon a springing deed-in-lieu of foreclosure if Canyon elected to declare another default. College Terrace stated that Canyon then intentionally caused construction delays to increase costs to the point where College Terrace was forced to admit Canyon's hand-picked crony developer into control of the project. By 2018, without any court proceeding being filed, Canyon's relentless acts ultimately led to College Terrace losing 100% of its equity in the project plus more money that Canyon reportedly coerced from the owners of College Terrace after the loan closing. All of this occurred without College Terrace missing or being late on a single loan payment. The property owners did not have funds to pay lawyers to fight Canyon and thus succumbed to Canyon's predatory acts.

Analysis: What Are Canyon's Tactics?

Canyon's Playbook Begins Well Before A Loan Closes

Canyon's Internal Pre-Closing Memo(s) -That Prospective Borrowers Don't Get to See - Boast That Canyon Will Be In A Position to Quickly Take Title

The excerpt at left, discovered from a Freedom of Information Act request to a public university after Canyon had already foreclosed, demonstrates the cultural mindset at Canyon. This stands in stark contrast to banks which have no interest in taking title - ever - let alone quickly. In fact, most lenders will do what they can to facilitate the repayment of their loan, and certainly not focus like Canyon does on being "in a position to quickly take title and control the Property at a significant discount to value."

Canyon Often Profits from Prospective Borrowers Without Even Closing a Loan

Canyon regularly issue term sheets at seemingly feasible terms and requires potential borrowers to fund deposits for Canyon’s due diligence expenses including Canyon’s legal fees. Prospective borrowers of course have to pay their own legal fees too. Later, after months of negotiations and after potential borrowers have paid large amounts for legal fees and other expenses, Canyon regularly renegotiates critical provisions from the original term sheet. When the borrowers are over a barrel - with expiring debt that they must refinance or have a purchase agreement with an approaching deadline or the like - prospective borrowers often have no choice but to accept Canyon’s last-minute loan changes. And, even if the prospective borrower is able to walk away at the eleventh hour, Canyon profits anyway. Canyon earns millions of dollars on deposits it takes on term sheets for loans it never closes and "without deploying any capital". See letter boasting about this at right.

Canyon Makes Pre-Closing Misrepresentations to Borrowers to Lull Them Into a False Sense of Security

As happened in near identical fashion to the College Terrace and Packard Square borrowers, Canyon’s loan originators said how great they are to work with, that they really understood construction, and that Canyon would be quite reasonable when it comes to construction issues. But when prospective borrowers ask Canyon to document this in the loan documents, Canyon makes up excuses and says things like, “We don’t want to get into an argument about what constitutes ‘reasonable’ approval. We’re motivated to see this project get complete so i think you’ll find in practice that we’re very reasonable. But we do not want to add a reasonability provision that would be open to interpretation and potentially delay the project.” And in the case of College Terrace, Canyon also lied about its foreclosure history, saying, "We have not foreclosed on a development deal from what I can remember."

In reality, after loans closed, Canyon has repeatedly weaponized the loan in myriad ways. One way is through the dozens of notice provisions in their loan documents which require the borrowers to keep Canyon immediately informed. Maria Stamolis and others at Canyon have ruthlessly used this information to figure out strategy ideas to default the borrower, withhold loan funds (that Canyon is charging interest upon) and usurp control. For instance, when a contractor sends a letter seeking payment for additional costs - as often occurs - a construction lender might simply seek to understand the issue and even assist with a solution. Construction projects routinely have contingency funds for these types of regular occurrences too but Canyon has preferred to figure out how this type of information could be used to default their borrower and benefit at their borrower's expense from the myriad issues that undoubtedly arise in a construction project.

Canyon Has Focused on Construction Loans - Is It Because Construction Issues Provide Ample Opportunities for Alleging Defaults, Withholding Funds and Blaming the Borrower?

Canyon has made development and construction loans at high (9-10%) rates of interest and insists upon rates of interest in the event of default that are 55-60% higher (i.e. 15.5% - 16%). To ensure high returns, loans were made on high-quality, very rare projects that often have taken many years or even more than a decade in pre-development work plus many millions of dollars for the projects to be shovel-ready. The key for Canyon is that they know development and construction projects regularly face unforeseen and often uncontrollable issues. Construction projects regularly suffer from delays in receipt of materials, changes required by the building officials, staffing issues at the general contractor or subcontractor firms, weather delays, labor disputes, strikes and much more. Undoubtedly each Canyon loan provides ample opportunities to declare and manufacture defaults simply by the sheer nature of the many uncontrollable parts in a construction project. When Canyon delays the release of loan funds or withholds loan funds entirely, this intentionally causes construction liens and ill will among the workers and suppliers. Failing to pay timely the contractors, suppliers, and the architect causes major issues and delays in the completion of the project. Contractors then move workers to other jobs out of fear of not being paid and the whole project slows and develops a bad reputation. Canyon therefore has taken advantage of construction issues by intentionally causing their borrowers further distress than is already commonplace in construction projects, withholding loan funds and then blaming their borrowers for liens.

Canyon Won’t Close Loans Unless It Gets Contract Language Which Can Easily Trip-up the Borrower

Canyon’s loan documents include dozens, if not more than fifty, different notice requirements for the borrower to inform Canyon of their every move. This excessive control allows Canyon to be able to continually figure out things that they can blame their borrowers for. There are also nuermous provisions in the contracts which require Canyon’s approval in their sole discretion. So borrowers are at Canyon’s mercy to hope that they act timely and in good faith. Delays by Canyon can slow the project or put the borrower into milestone defaults. But there are no deadlines or criteria for when Canyon must issue their approvals so valuable time ticks away while Canyon delays in responding. The closing documents also include dozens of separate documents which may total approximately 1000 pages with many provisions that are ambiguous or even conflicting – all designed for Canyon to manipulate matters as they see fit.

If you must close a loan with Canyon, insist that requirements on the Borrower are also the same for Canyon. For instance, if the borrower must insure that there is no other debt on the property, then Canyon should also be prevented to taking any action to add debt to the property. Or if something is subject to Canyon's approval, give them a deadline or it is automatically approved. These are just a couple examples.

Canyon Carefully Premeditates Jurisdiction and Venue, and Later May Lull You Into a False Sense of Security

Jurisdiction and venue is often glossed over by borrowers. These developers just want to build a nice building that will be rewarding for themselves, the occupants, and the community. With these goals in mind, they think that litigation is such a remote possibility that they spend little time negotiating where any subsequent litigation with Canyon might take place. For Canyon, because they have litigated hundreds of times and expect to litigate regularly, these provisions are crucial. Before the loan closes, Canyon picks their litigators, the court, the judge (if they can), the receiver etc. They figure out which local firms to hire to be effective in the appellate courts too. Canyon's litigation-ready mindset puts them many steps ahead of their unsuspecting borrowers and is designed to game the legal system as much as possible.

If a loan closes, just before they file suit, Canyon may say things like, "It was great to see you!" in emails and other friendly remarks on the telephone to pretend they are on your team and to lull you into a false sense of security that they are truly on your side. You will never think that they are secretly preparing a lawsuit. But they want you off guard. You don't know that you are being deceived. When they want to sue you in your hometown, they may bring you to Los Angeles and file suit while you are away to stay several steps ahead of you. They will not even tell you that they are contemplating litigation. But they may try to convince you to give them more money before filing suit in the hopes that they can take more from you or prevent you from having adequate funds to litigate against their army of lawyers. Unbelievably they may refuse to document any reason whatsoever for you to pay them more money but still demand it from you anyway.

Weaponizing the Minimum Yield Fee, Ammo In Canyon's Arsenal

The Minimum Yield Fee is one of the many weapons that Canyon has used to attempt to earn much higher Internal Rates of Return (IRR) than the stated loan interest rate.

What is a Minimum Yield Fee? Generally, in Canyon’s loans, it equals fifteen percent (15.0%) of the maximum potential loan amount. So, for instance, if a construction loan is for “up to a maximum of $100 million” then Canyon must receive $15 million no matter when the loan is repaid. For borrowers, this provision seems innocuous because the interest that they would normally expect to pay on a 30-42 month construction loan would normally exceed this amount.

So at the outset, borrowers don’t generally worry that this could become any added expense at all. The issue is that, Canyon, in multiple instances, has taken steps contrary to the interests of their borrowers and has covertly weaponized the Minimum Yield Fee to create returns for themselves far beyond the loan’s interest rate.

For example, when a borrower has been sent default notices, pre-negotiation agreements, forbearance agreements, a deed-in-lieu of foreclosure and/or has been threatened by other Canyon maneuvers and can no longer stand the pressure and treatment from Canyon, the borrower may feel forced to pay off their loan early. In that instance, per the contract terms the early repayment must include the full Minimum Yield Fee. So Canyon ends up receiving far more interest on the loan than was actually incurred at the time the borrower feels they have no choice but to pay off their loan prematurely.

In other words, when Canyon's borrowers feel threatened, many elect to refinance their loans earlier than planned. As a result, Canyon does not even need to come up with a foreclosure action to make much more money than the stated interest rate on the loan.

The Minimum Yield Fee is thus a powerful weapon in Canyon’s arsenal.

Canyon and Their Investors Hide Evidence

Canyon Investor, the Duke University Endowment (DUMAC), Has Fought to Conceal Their Communications Exchanged with Canyon. How Much Does Duke Know about Canyon's Tactics?

In a March 9, 2022 letter from an attorney for Dumac, Inc. and Gothic Corp, which are the investment arms of the Duke University endowment, Duke's attorney admitted that three subpoenas for documents and communications with Canyon were quashed via protective orders. It is curious why a prestigious university's multi-billion dollar endowment would be so fearful of disclosing their communications with Canyon Partners. The endowment is an investor in at least one of the projects that Canyon successfully foreclosed upon. Phone calls and requests for meetings with the endowment were also rebuffed.

We tried to call Neal F. Triplett, the president and CEO of DUMAC, to ask him why they are hiding their communications with Canyon Partners but he refused to talk to us.

Court Files Show that Highly Litigious Canyon Partners Has Hundreds of Lawsuits But Many Records Mysteriously Have Been Permanently Expunged

A review of the federal court website, Pacer, reveals more than 200 lawsuits involving Canyon entities. This does not include their myriad state court litigations, which are not easily searchable due to each court having their own record-keeping systems and many with pleadings unavailable on the internet. One would need to know the entity name which Canyon litigated under, the specific court where the action took place and then perhaps even travel to that courthouse to review the pleadings. In-person searches of some of those court records reveals that significant amounts of court pleadings have been permanently expunged. This is highly unusual as court records are almost always viewable by the general public. It is impossible to know why or how those records were expunged. Canyon has litigated under hundreds of entity names and it is impossible to find all of Canyon's litigation. Only Canyon knows all of the state and federal courts which they have litigated in but they have repeatedly refused to disclose their litigation history. For each loan, Canyon creates a new entity, often using the borrower's name as part of the lending entity name, so it is virtually impossible to find all of their lawsuits and expose the full pattern of their conduct.

Canyon's Lawyer, Sidley, Boasts About Getting Dismissed a Fraud and Racketeering Lawsuit against Canyon regarding Eleven (11) Canyon Victims

In a press release on the law firm's website, the Sidley law firm admits that the fraud and racketeering claims filed against the owners, key employees and Canyon entities were dismissed without any hearing and without any review of the merits of the claims. Sidley boasted that the plaintiff Packard "should have, brought its RICO and related state law claims in the Michigan lawsuits, and that Packard’s loss in those lawsuits precluded the action against Canyon Partners." In other words, the Canyon defendants undoubtedly paid millions of dollars to Sidley to get the fraud and racketeering lawsuit dismissed without any discovery in the case, without any evidentiary hearing and without any denial by Canyon that the 100+ pages describing the pattern of defrauding eleven borrowers - as pled with specificity in the complaint - is 100% true. In the preceding action, the Michigan Court also never allowed a witness to be heard, and never reviewed any of the fraud and racketeering claims so the Canyon defendants were able to easily get away with absolutely no judicial review of their alleged pattern of fraudulent acts against eleven borrowers, and were never held accountable for their misrepresentations to multiple courts. Download the full complaint below. And read the press release here: https://www.sidley.com/en/newslanding/newsannouncements/2020/02/sidley-achieves-dismissal-for-canyon-partners-in-rico-litigation

Fraud and Racketeering Complaint

Fraud and Racketeering Complaint (pdf)

DownloadA Dozen Tips To Guard Against Canyon's Deceptive Tactics

1. Canyon Has A Protocol Of Talking On The Phone When They Don't Want Their Statements Documented

3. Non-Monetary Defaults Are Declared Quickly By Canyon, Pressure Is Applied to Gain An Unfair Advantage

1. Canyon Has A Protocol Of Talking On The Phone When They Don't Want Their Statements Documented

Multiple borrowers report receiving phone calls from Canyon that contradicted what Canyon later put in writing. Gerald Goldman and others at Canyon convey support on the telephone and in person. Goldman even calls ahead to tell borrowers not to worry about forthcoming default letters. He repeatedly has said that Canyon just needs those

Multiple borrowers report receiving phone calls from Canyon that contradicted what Canyon later put in writing. Gerald Goldman and others at Canyon convey support on the telephone and in person. Goldman even calls ahead to tell borrowers not to worry about forthcoming default letters. He repeatedly has said that Canyon just needs those default letters for their files. Later, after borrowers have been lulled into a false sense of security, Canyon repeatedly uses those default letters against its borrowers.

If you are unfortunate enough to do business with Canyon, it is highly recommended that you send written minutes to Canyon after every phone call or say that all calls will be recorded and transcribed. This way, Canyon may think twice before telling lies or at least their lies will be documented. Anyone who does business with Canyon should be sure to create an evidence trail - especially the immediate documentation of every phone call.

2. Canyon Aggressively Creates False Urgencies by Manufacturing and Imposing Artificial Deadlines

3. Non-Monetary Defaults Are Declared Quickly By Canyon, Pressure Is Applied to Gain An Unfair Advantage

1. Canyon Has A Protocol Of Talking On The Phone When They Don't Want Their Statements Documented

Canyon will often say they need something signed immediately with no valid reason for the urgency. They even withhold funds or approvals and demand that things be signed without allowing for the borrower’s counsel to review the proposed document. Anyone who does business with Canyon should push back on those demands and indicate that th

Canyon will often say they need something signed immediately with no valid reason for the urgency. They even withhold funds or approvals and demand that things be signed without allowing for the borrower’s counsel to review the proposed document. Anyone who does business with Canyon should push back on those demands and indicate that they will not be pressured into signing things quickly and certainly not without their counsel weighing in.

3. Non-Monetary Defaults Are Declared Quickly By Canyon, Pressure Is Applied to Gain An Unfair Advantage

3. Non-Monetary Defaults Are Declared Quickly By Canyon, Pressure Is Applied to Gain An Unfair Advantage

3. Non-Monetary Defaults Are Declared Quickly By Canyon, Pressure Is Applied to Gain An Unfair Advantage

Once loans are closed, Canyon looks for opportunities to pounce. Canyon brainstorms internally for possible default and strategy ideas, even manufactures requirements that don’t exist (like in the case of College Terrace), and then declares defaults as early and often as possible. Canyon papers their files with default letters and pressu

Once loans are closed, Canyon looks for opportunities to pounce. Canyon brainstorms internally for possible default and strategy ideas, even manufactures requirements that don’t exist (like in the case of College Terrace), and then declares defaults as early and often as possible. Canyon papers their files with default letters and pressures borrowers to admit defaults in writing by withholding funds and approvals.

With Canyon’s loans, generally reserves for interest, property taxes and insurance are set aside upfront. For years, a payment default is not possible. But, Canyon prowls for non-monetary defaults because they are stealthily eyeing to implement the substantially higher default rate of interest listed in the loan documents. This is not typical of banks, life insurance companies and other honest lenders, which seek to avoid putting loans into default. These lenders are regulated and generally only declare defaults if loan payments are missed, and are certainly not aggressively coming up with non-monetary defaults to declare as Canyon has done.

4. Canyon Tries to Get Borrowers to Sign Deed-In-Lieu of Foreclosure Documents to Wipe Them Out

4. Canyon Tries to Get Borrowers to Sign Deed-In-Lieu of Foreclosure Documents to Wipe Them Out

3. Non-Monetary Defaults Are Declared Quickly By Canyon, Pressure Is Applied to Gain An Unfair Advantage

Despite only their alleged non-monetary defaults, Canyon has repeatedly attempted to get borrowers to give them an immediate deed-in-lieu of foreclosure or a deed-in-lieu of foreclosure which springs into effect whenever Canyon elects to declare another default.

This is shocking because the borrower's lifetime of education, career progre

Despite only their alleged non-monetary defaults, Canyon has repeatedly attempted to get borrowers to give them an immediate deed-in-lieu of foreclosure or a deed-in-lieu of foreclosure which springs into effect whenever Canyon elects to declare another default.

This is shocking because the borrower's lifetime of education, career progress which gave them the expertise to find and undertake the project, financial investment and equity created in the project, reputation, capital for future endeavors and more would be instantly, as Maria Stamolis said, "Wiped out!" Watch her testimony on the Videos page.

5. Canyon Secretly Has Their Attorneys Review Routine Emails

4. Canyon Tries to Get Borrowers to Sign Deed-In-Lieu of Foreclosure Documents to Wipe Them Out

5. Canyon Secretly Has Their Attorneys Review Routine Emails

On construction projects, lenders approve draw requests on a daily basis. Simple emails are normally exchanged in this regard. At Canyon, in-house and outside lawyers approve the most routine emails because it seems that Canyon is always preparing for litigation.

Canyon also regularly copies lawyers on emails, even when it does not invo

On construction projects, lenders approve draw requests on a daily basis. Simple emails are normally exchanged in this regard. At Canyon, in-house and outside lawyers approve the most routine emails because it seems that Canyon is always preparing for litigation.

Canyon also regularly copies lawyers on emails, even when it does not involve legal advice, the attorney's name is then used as a shield by Canyon later to hide that email from being discovered. In the foreclosure litigation with Packard Square, Canyon listed over 6500 emails this way on their privilege log.

On the Videos page, watch Canyon's CFO, John Plaga, testify about whether Canyon's owners, Mitch Julis and Joshua Friedman, have a protocol to always include lawyers on emails.

6. Canyon Regularly Pressures Borrowers to Sign Releases

4. Canyon Tries to Get Borrowers to Sign Deed-In-Lieu of Foreclosure Documents to Wipe Them Out

5. Canyon Secretly Has Their Attorneys Review Routine Emails

Canyon regularly requires the signing of forbearance agreements and loan amendments as “accommodations” in order to pretend later that they were very reasonable and had given their borrower many chances. Canyon will initiate these amendments but write in the recitals that the borrower requested the accommodation or insert some other langu

Canyon regularly requires the signing of forbearance agreements and loan amendments as “accommodations” in order to pretend later that they were very reasonable and had given their borrower many chances. Canyon will initiate these amendments but write in the recitals that the borrower requested the accommodation or insert some other language to feign that Canyon was doing a favor for the borrower. Canyon also continually pressures borrowers to sign agreements which waive any allegations against Canyon.

Often Canyon will send pre-negotiation agreements to prevent borrowers from using evidence against Canyon in litigation and to get released from claims to date. Canyon will even withhold loan funds and approvals to pressure borrowers to sign what Canyon wants executed. With time ticking away on the required milestone deadlines and interest reserves being depleted, borrowers often have no choice but to succumb to Canyon's demands.

7. Draw Funds are Withheld (Yet Interest is Still Charged) While Canyon Demands Money and Changes to the Deal

7. Draw Funds are Withheld (Yet Interest is Still Charged) While Canyon Demands Money and Changes to the Deal

7. Draw Funds are Withheld (Yet Interest is Still Charged) While Canyon Demands Money and Changes to the Deal

To put its borrowers under duress, Canyon withholds draw funds, declares non-monetary defaults, demands default interest and fees, requires pre-negotiation agreements to be executed, and pressures borrowers to sign forbearance letters, loan amendments, reinstatement agreements and the like. Canyon demands that borrowers execute revisions

To put its borrowers under duress, Canyon withholds draw funds, declares non-monetary defaults, demands default interest and fees, requires pre-negotiation agreements to be executed, and pressures borrowers to sign forbearance letters, loan amendments, reinstatement agreements and the like. Canyon demands that borrowers execute revisions to agreements as part of their efforts to get borrowers to acknowledge defaults while simultaneously trying to get itself fully released. And, as mentioned above, Canyon will even write in the recitals to the amendments that it is being done at the request of the borrower.

And of course, Canyon would be very happy if borrowers get frustrated and pay them off early because early repayment requires full payment of the Minimum Yield Fee (which from the borrower’s perspective was not supposed to be fully accrued for 2-3 years). Early repayment drives up Canyon’s XIRR (exit internal rate of return) to very high rates by essentially capturing some of the borrower’s equity due to the early repayment. See more about weaponizing the Minimum Yield Fee above.

8. Default Interest Comes Into Play Regularly on Canyon’s Loans and Is Highly Problematic for Borrowers

7. Draw Funds are Withheld (Yet Interest is Still Charged) While Canyon Demands Money and Changes to the Deal

7. Draw Funds are Withheld (Yet Interest is Still Charged) While Canyon Demands Money and Changes to the Deal

By charging the default interest rate, borrowers have less time before their interest reserves run out and their project becomes less profitable. This makes it easier for Canyon to declare the loan out-of-balance and to demand the borrowers put in more money, which of course puts financial pressure on the borrower while making the loan m

By charging the default interest rate, borrowers have less time before their interest reserves run out and their project becomes less profitable. This makes it easier for Canyon to declare the loan out-of-balance and to demand the borrowers put in more money, which of course puts financial pressure on the borrower while making the loan more lucrative for Canyon. Furthermore, if borrowers succumb to Canyon’s demands, they have less funds to fight in the event of litigation, less working capital to pay costs to refinance and other deleterious effects.

9. Canyon's Actions Are Aided and Abetted by Overpaid, Complicit Sycophants

7. Draw Funds are Withheld (Yet Interest is Still Charged) While Canyon Demands Money and Changes to the Deal

10. Canyon Will Exercise Excessive Control To Manipulate Issues Against the Borrower

Canyon would not be so successful without many complicit sycophants - all too willing to carry out their missions since they are paid so handsomely. Whether it's their army of lawyers, many being paid well over $1000 per hour, complicit receivers, moles such as Janine Getler (whose law license is used to shield her communications yet th

Canyon would not be so successful without many complicit sycophants - all too willing to carry out their missions since they are paid so handsomely. Whether it's their army of lawyers, many being paid well over $1000 per hour, complicit receivers, moles such as Janine Getler (whose law license is used to shield her communications yet those emails rarely involve legal advice) and her sidekick, Canyon's former employee, Tina Van Curen, the list of aiders and abettors is long. They fly first-class, get fancy expenses paid for and are massively overpaid in exchange for their misrepresentations to courts, falsities in affidavits and declarations, and willingness to coluude to default borrowers. On the Packard Square project, Canyon fired their construction consultant, Newbanks, because Newbanks was unwilling to misrepresent the condition of the property. That's when Canyon brought in Janine Getler and Tina Van Curen who were perfectly willing to carry out Canyon's wishes. Watch Tina Van Curen's video regarding her "affidavit" on the More Foreclosures page.

10. Canyon Will Exercise Excessive Control To Manipulate Issues Against the Borrower

12. After Damaging the Reputation of a Borrower's Asset, Canyon Will Change The Property Name To Hide The History of Their Predatory Acts

10. Canyon Will Exercise Excessive Control To Manipulate Issues Against the Borrower

Repeatedly Canyon will say "we are just your lender” but in reality, they exercise excessive control and do not operate like a normal lender. They demand to attend meetings and conference calls with contractors, call potential refinance lenders, interfere and talk to them behind your back, and undertake other acts to use information as a

Repeatedly Canyon will say "we are just your lender” but in reality, they exercise excessive control and do not operate like a normal lender. They demand to attend meetings and conference calls with contractors, call potential refinance lenders, interfere and talk to them behind your back, and undertake other acts to use information as a weapon.

Anyone who has no choice but to do business with Canyon should have someone full-time poring over loan documents, documenting every conversation and declaring Canyon in default every time that they fail to respond timely, fail to fund draws timely or do something else that is predatory, interferes or is a breach of the loan documents. It is unusual for a borrower to declare their lender in default but that it what should be done repeatedly to survive a transaction with Canyon.

11. Canyon's Construction Milestone Requirements Are An Excuse to Put Borrowers Into Default

12. After Damaging the Reputation of a Borrower's Asset, Canyon Will Change The Property Name To Hide The History of Their Predatory Acts

12. After Damaging the Reputation of a Borrower's Asset, Canyon Will Change The Property Name To Hide The History of Their Predatory Acts

Canyon loves to use milestone defaults as an excuse to default borrowers and install a complicit receiver or crony developer. Canyon's alleged concern over being behind schedule disappears once they have displaced the property owner, seized control of construction and are charging a high default interest rate and added fees. At that poi

Canyon loves to use milestone defaults as an excuse to default borrowers and install a complicit receiver or crony developer. Canyon's alleged concern over being behind schedule disappears once they have displaced the property owner, seized control of construction and are charging a high default interest rate and added fees. At that point, the borrower's equity is being taken rapidly by Canyon so they are perfectly happy with slow construction.

A developer is always incentivized to save time and money. It doesn't need milestone requirements in the contract. Once Canyon is able to seize control of the asset, the incentives become reversed because Canyon makes more money if it takes longer. Anyone who does business with Canyon should never agree to language that would allow a receiver to be appointed and certainly not without a jury trial.

12. After Damaging the Reputation of a Borrower's Asset, Canyon Will Change The Property Name To Hide The History of Their Predatory Acts

12. After Damaging the Reputation of a Borrower's Asset, Canyon Will Change The Property Name To Hide The History of Their Predatory Acts

12. After Damaging the Reputation of a Borrower's Asset, Canyon Will Change The Property Name To Hide The History of Their Predatory Acts

Canyon creates a new single-purpose entity to be the lender in each loan transaction and often takes the unusual step of putting the borrower's name into their entity name. That way, when litigation is started, the borrower's name is all over the legal pleadings, not Canyon's.

Canyon's failure to fund draws, and actions such as starting f

Canyon creates a new single-purpose entity to be the lender in each loan transaction and often takes the unusual step of putting the borrower's name into their entity name. That way, when litigation is started, the borrower's name is all over the legal pleadings, not Canyon's.

Canyon's failure to fund draws, and actions such as starting foreclosures and lawsuits - all damage a property's reputation. Canyon of course knows these things. So, they not only litigate in an entity name that looks like the borrower's name, but once they have seized control of the asset, they change the property name. Canyon has done this on multiple occasions to bury the mess that they caused and leave only the borrower's reputation destroyed.

Canyon Vastly Increases Returns by Preventing Loan Repayment

Why Would Canyon Want To Prevent Loan Repayment?

Making repayment very difficult has several financial benefits for Canyon:

First, the longer it takes a borrower to repay a loan, then more interest is required to be paid to Canyon.

Second, if a borrower goes past the loan expiration date before repaying, then high default interest rates and massive late fees of roughly 5% of the loan amount kick-in and must be paid before Canyon will discharge their mortgage.

Third, refinance lenders can get discouraged and fatigued if repayment is too difficult, thus potentially giving Canyon the opportunity to foreclose if a refinance cannot be effectuated.

In fact, Canyon has made loan repayment so difficult that they have refused to put language in loan documents which requires them to provide customary payoff letters. They have even refused altogether to provide payoff letters without a court order. And, even with a court order, Canyon has still delayed for months thereafter and then only provided completely unsupported payoff letters that expired within 24 hours and excluded customary per diem interest charges.

Canyon's loan documents also require weeks of advanced notice of the repayment date and that repayment funds only come from an account in the borrower's name. This is especially difficult because refinance lenders generally cannot pinpoint closing dates weeks in advance, and they do not want to advance money into a borrower's account until a title company has assured them that Canyon's mortgage will be discharged and their new mortgage will be recorded in first position.

Canyon's highly unusual and unnecessary hoops that borrowers must jump through to repay a loan are all designed to force the borrower to pay Canyon extra money or prevent repayment entirely.

Earlier in the loan term when a large amount of the Minimum Yield Fee has not been incurred, Canyon often seeks to cause an early repayment, because that too drives the IRR up significantly. So, whether it is causing early repayment to get the Minimum Yield Fee paid prematurely or causing late repayment to get paid massive late fees, default interest and/or even to foreclose, in both scenarios, Canyon has figured out how to capture much more than the stated interest rate on its loans.

Canyon's Litigation Tactics

Forced To Litigate With Canyon?

These Are Some of Their Tactics That You May Expect:

If you are so unfortunate as to end up in litigation with Canyon, get ready for Canyon's army of lawyers to use every trick imaginable to win their case. Canyon has been involved in hundreds of lawsuits so they are well-versed in the courts and will covertly plan many steps ahead of you. You can expect some or all of the following tactics which have been used by Canyon and its counsel in the past:

1. Communication Abruptly Cut-Off - Canyon will call you constantly during the loan term to extract information but once they have started a lawsuit and want your property, they will cut off all communication and demand that all communication be through attorneys. Canyon doesn't want to hear their borrowers literally screaming and crying when they have been locked out of their own properties which they have put their heart, soul, education, expertise and life savings into for decades.

And, remember, when they want to sue you in your hometown, they may bring you to Los Angeles and file suit while you are away to stay several steps ahead of you. They will not even tell you that they are contemplating litigation.

2. Concealing Evidence - Canyon delays discovery with a slowly “rolling” production, and hides altogether from discovery by using baseless objections and providing meaningless or vague answers to interrogatories and requests for admissions. This forces the party opposing Canyon to file countless Motions to Compel, while Canyon regularly files Motions to Quash Discovery not only of its own documents, but also to quash discovery of documents from third parties if Canyon thinks they have something which could hurt Canyon’s case. Even if a borrower wins a motion to compel, Canyon will still not comply and force the borrower to repeat the process. Canyon plays these games until the discovery period runs out and they avoid altogether turning over evidence.

3. Protective Orders - Early in the case, before the borrower realizes how Canyon will use it to their advantage later, Canyon’s counsel seek protective orders so it’s opposition can’t use evidence in other litigation. Then, regardless of whether a document has any merit of actually being proprietary or a trade secret, their counsel marks documents produced with a “Confidential” watermark. This places an unduly large burden upon borrowers to pour over thousands of pages of documents, and a borrower would have to go to court to get the improper “Confidential” status revoked.

4. Canyon Cherry-Picks What It Produces - When Canyon finally does start producing documents, it sanitizes and “scrubs” what is produced, and instead of producing what was requested, they produce many multiple copies of irrelevant documents (such as your own loan documents, specifications, plans, etc) – thus giving the false appearance to courts of producing tens of thousands of pages of documents, when in reality all they have done is created a smokescreen which prevents the key documents from being discovered. Then, having produced tens of thousands of pages of useless materials that you already had, Canyon likes to say that “everything” has already been produced. However, sometimes you might get lucky and obtain discovery from a third party which proves that Canyon’s production was far from complete. More often than not, you will find that Canyon has withheld or “scrubbed” the most important information which may be damaging to its legal position.

5. Canyon May Litigate Against You in Multiple Courts - Since Canyon’s loan documents require borrowers to waive many statutory rights – including the “One Action Rule” which would normally require Canyon to bring all claims in one court – this allows Canyon to bring multiple actions and claims in multiple courts, and borrowers lose critical defenses that the state legislatures had put in place to protect people from just this type of hyper-aggressive litigation.

6. Canyon Hires Lawyers Who Are Willing to Say Anything to Judges - Canyon’s lawyers are paid so much that they are not afraid to say almost anything in court, even if it has no basis in fact and their lawyers know the statements are false. Canyon’s counsel often gets away with this by hiding behind the shield of “zealous advocacy” – and it is very difficult for borrowers to prove the misrepresentations on the spot since their own lawyers are usually the ones speaking on their behalf and cannot possibly be well-versed in everything that the borrower knows. Plus Canyon has often concealed, delayed or prevented the discovery of evidence to prove that lies were told to courts.

Some of Canyon’s many contradictions may be discovered from evidence obtained in other cases and from other borrowers. While Canyon may be telling a court that your property is in shambles, they may be concurrently telling their investors, like Duke University's Endowment, DUMAC, or CalPERS, that it is a fabulous investment.

7. Canyon Constantly Seeks Technical Ways to Prevent You from Bringing Your Counter-Claims or Reorganizing in Bankruptcy Court - If you file a counter-claim or file any motions, Canyon will seek dismissal of your suit or motion on technicalities so the merits of your case or motion are never heard. In bankruptcy court, they may low-ball the value of your property and make other misrepresentations to get your bankruptcy dismissed so you can't repay your loan through a Chapter 11 filing.

8. Canyon Disregards The Court Rules - Canyon’s lawyers have been known to break the law and issue subpoenas without informing you, or send them to you after it is too late for you to exercise your right to object. They may also file motions and other documents but not serve you or give you the time prescribed by the court rules to respond. This will then force you to raise this with the court and try to undo the damage Canyon has done to you - all while you are paying legal fees to right their wrongful acts.

9. Canyon Tells Its Investors and Courts Contradictory Things - Canyon will make representations to courts which are contradictory to things that they have told their own investors. It is for this reason that Canyon aggressively tries to block discovery of its investment committee meeting minutes and communications with investors because they don’t want to get caught in their contradictions. It would be incredible to juxtapose Canyon's internal emails against its concurrent emails to its borrowers and investors. Undoubtedly the contradictions would be stark.

10. Canyon Will Say Contradictory Things to Different Courts - Canyon will represent different things at different times to different courts as convenient for them. To litigate with Canyon, your attorneys really have to be well versed and prepared to point out those contradictions on the spot at oral arguments, which is very hard to do.

11. Canyon Will Misrepresent the Contract Terms - To courts, Canyon will misrepresent the contract terms to argue things which were never intended. They will use their own poorly drafted language, which they refused to modify during loan negotiations, to argue that your contract says something that it doesn't, and will ignore things in your contract that work against them.

12. Be On Guard for Deception - If you have contracted with Canyon, you may face a devious enemy, as opposed to a normal lender who wants to build a relationship and just wants their loan repaid with interest. Be careful at every moment, especially during litigation!

This is just a partial list of the litigation nightmares you can expect if you are forced to litigate with Canyon. We will add to this list as there are certainly more points on this topic.

Wondering Canyon's Default Rate vs The U.S.A. Rate? Us Too.

Is Canyon's Rate of Declaring Defaults Higher Than National Rates?

Nationwide, the commercial property default rate has been extremely low since the 2008 financial crisis, as depicted in this chart at right utilizing data from the Federal Reserve. It would be great if Canyon would disclose their list of loans to date and the default letters issued on each so we could publish an exact percentage here. Thus far, Canyon has flatly refused to disclose this information. Borrowers have a right to know!

The Canyon Partners Hedge Fund Is Highly Litigious!

The 8-Page List Below Includes Only Federal Court Litigation!

Canyon Has Nearly 200 Federal Court Lawsuits!

Scroll Through Eight (8) Pages of Canyon's Lawsuits Below

Download PDFCanyon Redacts Foreclosure Info

See Jonathan Kaplan's Affidavit Below

Kaplan declared that, "The Company derives economic value from retaining the confidentiality of the Redacted Information..." and "has taken reasonable measure to prevent the disclosure of the Redacted Information..." from its publicly available reports.

Canyon Alleged Their Foreclosure Reports Are Copyrighted

Canyon Is Fighting to Keep Hidden Other Defaulted Loans

Letter to TX Attorney General Tries to Stop Default Exposure

The below May 20, 2022 letter from Canyon's attorney seeks to prevent the release of information pursuant to a Freedom of Information Act Request and states, "The Request seeks the types of information provided by Canyon Partners... including... non-performing loan advisories, notices of default, default letters ... Because this information is highly confidential and subject to multiple layers of confidentiality agreements, Canyon Partners objects to disclosure of this information."

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.